Equity and Capital Markets

Summary: You can grow money in different ways

Investment Fundamentals

- Investment is less now for more later

- Real Assets can do things, financial assets are claims on real assets

- Debt: Money Markets (Certificates of deposit, T-bills, commercial paper), bonds, preferred stock (mixed)

- Treasury Notes/Bonds: U.S. gov

- Municipal Bonds: Issued by state/local gov’t, tax-free interest.

- Corporate Bonds: Issued by companies, taxed, more risk.

- Others: Mortgage-backed, international, agency bonds.

- Equity: Claim to a part of a company

- Common Stock: Ownership, voting rights, dividends, highest risk.

- Preferred Stock: Fixed dividends, no voting rights, lower risk.

- ADRs: U.S.-traded shares of foreign companies.

- Derivative: Based off value of something else

- Options: Right to buy/sell (Call = buy, Put = sell)

- Futures: Obligation to buy/sell later

- Futures vs. Forwards: Futures = traded, standardized; Forwards = private, customizable

- Debt: Money Markets (Certificates of deposit, T-bills, commercial paper), bonds, preferred stock (mixed)

- Big companies separate ownership (shareholders) from management (executives), ensure leaders act in shareholder interests.

- Ethical failures like accounting scandals (Enron, WorldCom) cost companies billions.

- Corporate Governance and Ethics: Trust is super important.

- Poor governance adds to costs and hurts public confidence, Sarbanes-Oxley Act made after scandals to enforce stricter rules.

- Investment Process: Asset Allocation (What category I buy?) -> Security Selection (What exactly will I buy?) -> Risk vs Return (What category am I willing to lose?)

- Efficient Markets: In an efficient market, prices reflect all available information.

- Active management tries to beat the market, passive management copies

- Financial Players:

- Business Firms: Borrow money to grow.

- Households: Save and invest.

- Governments: Borrow or save.

- Financial Intermediaries: Help connect borrowers and lenders (banks, investment firms, etc.).

- 2008 Financial Crisis: Banks gave out too much in loans and people losing jobs made everything a lot worse.

- Equity Return: Return = Dividend Yield + Capital Gain (How much it went up)

- Market Indexes track market performance.

- Weighting Types:

- Price-weighted (based of price of share, ex. DJIA)

- Value-weighted (based off value of company, ex. S&P 500)

- Equal-weighted (everything is same percentage)

Securities Markets and Trading

- Primary Market: Company sells new shares and gets the money.

- Secondary Market: Investors trade shares; company doesn’t get any money.

- Private (Up to 499 shareholders, fewer public disclosures.) vs. Public (Shares sold to the public, must register with the SEC, per Securities Act of 1933)

- IPO (Initial Public Offering): First time a company sells shares to the public.

- SEO (Seasoned Equity Offering): A public company selling more shares later on.

- Underwriting

- Investment banks buy shares from the company, sell to public.

- They help with legal filings, pricing, and marketing (roadshows).

- Bookbuilding: Gauge demand from big investors to set price.

- Shelf Registration: Pre-approval to sell shares anytime within 2 years (SEC Rule 415).

- Trading Securities: Goal is easy and cheap buying/selling of assets.

- Direct Search: Find buyers/sellers yourself.

- Brokered: Use agent to find match.

- Dealer: Buy/sell from middleman.

- Auction: Everyone meets in one place (e.g., NYSE).

- Orders: Market: Fill me now! Limit: Fill me if it’s good enough. Stop: Fill me if it’s against me too much

- U.S. Exchange Markets

- NYSE: Big companies, auction-based.

- AMEX: Mid-size firms, ETFs.

- NASDAQ: Tech-heavy, dealer-based.

- OTC: Smaller, less regulated, lower volume.

- Trading Costs

- Commission: Fee to broker.

- Spread: Difference between bid and ask price.

- Brokers: Full-Service (Advice + trading like Merrill Lynch) or Discount (Just trading like Schwab, E*Trade)

- Buying on Margin: Buying with Borrowed Money.

- Initial Margin Requirement (IMR): You must fund at least 50%.

- Maintenance Margin: If your equity falls too low (e.g., 25–40%), you get a margin call.

- Formula for Call: Price ≤ Borrowed / (1 − Maintenance Margin)

- Short Selling: Betting stock falls by borrowing and sell shares, then buying back later.

- Need to put up margin, margin call if not enough money

- Call Price Formula: Price ≥ Total Margin / (1 − Maintenance Margin)

Mutual Funds, Hedge Funds and Others

- Investment Companies: Manage money from investors. Offer diversification, professional management, and lower costs.

- NAV (Net Asset Value) = Total assets minus liabilities, per share.

- Types of Investment Companies

- Unit Investment Trusts: Fixed portfolio, no active trading.

- Open-End Funds (Mutual Funds): Shares are bought/sold at NAV.

- Operating Expenses: Admin and management.

- Front-End Load: Fee when you buy

- Back-End Load: Fee when you sell

- 12b-1 Fees: Marketing

- Closed-End Funds: Shares traded like stocks; price may be above or below NAV.

- Sold via IPO, then traded like stocks.

- Often sell below NAV (at a discount, due to illiquidity premium).

- Dividends paid to investors.

- Others:

- Commingled Funds: For large investors like pension funds.

- REITs: Invest in real estate.

- Hedge Funds: High-risk, for the wealthy, few rules.

- Exchange-Traded Funds (ETFs)

- Traded all day like stocks.

- Usually track indexes (passively managed).

- Lower costs, tax efficient, small NAV deviations.

- Hedge Funds: Only for wealthy individuals/institutions.

- Less Transparent and less Liquid: Lock-up periods (1–3 years).

- Fee Structure: 1–2% management fee + 20% of profits over high water mark (benchmark)

- Strategies:

- Long/Short Equity

- Market Neutral

- Arbitrage (Merger, Convertible, Fixed-Income)

- Event-Driven

- Global Macro (World situation)

- Statistical/High-Frequency Trading

- Fund of Hedge Funds: Invest in multiple hedge funds, but with extra fees.

- Higher risk, higher potential returns (but less regulated).

- Behavioral Factors: Emotional stress (e.g., divorce) can hurt manager performance.

- Metrics Used:

- Mean: Average return (geometric mean is multiple all to the power of 1/n)

- Variance/Standard Deviation: Risk (how much returns vary).

- Covariance/Correlation: How assets move together.

Risk and Return

- Holding-Period Return (HPR): (P1 + D1)/P0 – 1

- Income Yield (D1): Dividend divided by initial price.

- Capital Gain: Price increase divided by initial price.

- Expected = forecasted, Realized = actual. They often differ.

- If Compounding Returns: (1 + r1)(1 + r2)…(1 + rn) – 1

- Averages:

- Arithmetic: Simple average

- Geometric: Compounded average

- Dollar-weighted: Adjusted for money invested over time

- Risk and Sharpe Ratio: Risk = Uncertainty, Measured by standard deviation (volatility)

- Other Risk Measures:

- Skew: Tilt of distribution

- Kurtosis: Likelihood of extreme outcomes

- Sharpe Ratio (high is good) = (Return – Risk-Free Rate) / Std. Dev

- Risk Aversion: Investors prefer certainty.

- To take on risk, they demand a higher return (risk premium).

- Capital Allocation Line (CAL) & Capital Market Line (CML)

- CAL: Combines a risk-free asset with a risky portfolio.

The slope = Sharpe Ratio.- Optimal Portfolio: Tangent point from the risk-free rate to the efficient frontier.

- This point gives the best Sharpe Ratio (optimal risky portfolio).

- CML: CAL using the market portfolio as the risky asset.

- You can leverage to get more return (borrow at risk-free rate to invest more in risky assets).

- CAL: Combines a risk-free asset with a risky portfolio.

- Diversification: Spreading money across multiple assets reduces risk.

- Goal: Combine assets with low or negative correlation to reduce overall risk.

- Types of risk: Systematic (market) and Unsystematic (firm-specific)

- Two Risky Assets

- Portfolio Return = Weighted average of individual returns

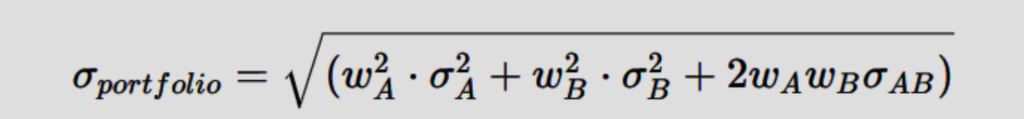

- Portfolio Risk = Depends on Individual risks and Correlation

- Correlation between assets

- If correlation = -1: Perfect diversification.

- If correlation = 1: No diversification benefit.

- Correlation between assets

- Efficient Frontier is the set of best portfolios (highest return for each level of risk).

- Dominated portfolios: Lower return for more risk → avoid them.

- Efficient portfolios lie above the “minimum variance” portfolio.

- Combine it with risk-free asset to suit risk tolerance.

- Portfolio Applications

- Target a specific risk level

- Find the minimum variance portfolio

- Build the complete portfolio (risky + risk-free mix)

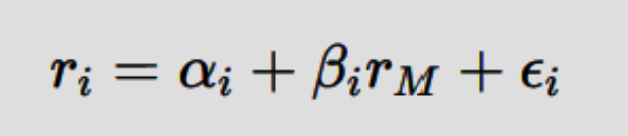

- Single-Index Model: How stock returns relate to the market:

- Alpha: Extra return not explained by the market

- Beta: Sensitivity to market movements

- Epsilon: Firm-specific noise

Capital Asset Pricing Model

- Capital Asset Pricing Model (CAPM) predicts how much return a stock should give based on: Risk-free rate, Market return and beta (β) risk vs. the market

- Formula: Expected Return = Risk-Free Rate + Beta x (Market Return – Risk-Free Rate)

- Key Assumptions of CAPM

- Everyone agrees on expected returns and risks

- No trading costs, taxes, or restrictions

- Investors can borrow/lend as much as they want at the risk free rate

- Everyone owns the same market portfolio (all assets weighted by value)

- Beta measures a stock’s sensitivity to market moves. Market’s beta = 1

- If > 1 then stock is more volatile than the market

- Portfolio beta = weighted average of individual betas

- SML vs. CML

- SML (Security Market Line): plots return vs. beta, works for any asset

- CML (Capital Market Line): plots return vs. standard deviation (volatility), only applies to efficient portfolios

- Alpha = actual return – CAPM predicted return

- Positive alpha: stock outperformed CAPM → could be underpriced

- Negative alpha: stock underperformed → could be overpriced

- Underpriced (return > CAPM return) vs. Overpriced (return < CAPM return)

- Diversification: Holding many stocks reduces firm-specific (unsystematic) risk

- 20–30 stocks eliminates most of this risk

- Market risk (systematic) cannot be diversified away

- Application Examples

- Use different betas and returns to find if stocks are fairly priced

- Solve for market risk premium or risk-free rate if given two portfolios

- Perception vs. Reality: If you think a bad company is not as bad as others think it can be a good buy, market prices reflect average belief (George Soros strategy)

Behavioral finance and investment strategies

- Efficient Market Hypothesis (EMH): Prices reflect all available info.

- Prices move randomly and there’s no predictable patterns.

- You can’t get high returns without taking more risk.

- Markets become more efficient when investors compete and react fast to info. Arbitrage corrects mispricing.

- Types of Market Efficiency

- Weak Form: Prices reflect all past price data. Technical analysis won’t help.

- Semi-Strong Form: Prices reflect all public info. Fundamental analysis won’t help.

- Strong Form: Prices reflect all info, even insider info. No one has an edge.

- Technical Analysis

- Uses price charts, trends, and volume to predict movements.

- Believes prices adjust slowly to new info.

- Fundamental Analysis

- Looks at earnings, dividends, and company data.

- Active managers rarely beat the market.

- Market Anomalies (Strategies that seem to beat the market):

- Small-Firm Effect: Small stocks outperform.

- Neglected Firm: Unpopular stocks do well.

- Value Investing: Low P/E or book-to-market stocks do better.

- Momentum: Winners keep winning.

- Post-Earnings Drift: Prices slowly react to earnings news.

- Interpreting Anomalies: Could be due to bad risk measures, trading costs, data mining, risk premiums or inefficiencies.

- Behavioral Finance: Psychology to investing behavior.

- Investors make mistakes and act irrationally, so prices may not reflect true value.

- Key Theories

- Prospect Theory: People fear losses more than they value gains.

- Loss Aversion: Losses hurt more than equivalent gains feel good.

- Mental Accounting: We treat money differently depending on where it comes from.

- Information Processing Errors

- Forecasting Errors: Rely too much on recent events.

- Overconfidence: Think we’re better than we are (especially men).

- Conservatism: Too slow to react to new info.

- Sample-Size Neglect: See patterns in too little data.

- Biased Self-Attribution: Take credit for wins, blame bad luck for losses.

- Behavioral Biases

- Disposition Effect: Hold losers, sell winners.

- Framing: Decisions change based on how info is presented.

- Regret Avoidance: Avoid choices that might cause future regret.

- Ambiguity Aversion: Avoid unfamiliar investments (e.g., foreign stocks).

- Technical Analysis & Behavioral Finance

- Moving Averages & Trends: Used to find direction.

- Sentiment Indicators: Gauge mood of the market (short interest, put/call ratio).

- People often see patterns that don’t exist (me drawing fictional supports when I’m down)

Equity Valuation

- Equity Valuation: Comparing what a stock is really worth to what it’s selling for on the market.

- Valuation Methods

- Dividend Discount Model (DDM): Values a stock by estimating all future dividends and discounting them back to the present.

- Use if consistent dividends and expected steady growth

- Gordon Growth Model: A version of DDM that assumes dividends grow at a constant rate.

- Use if dividends grow at a constant rate forever and steady growth

- FCFF (Free Cash Flow to Firm): Cash left for all investors (debt + equity).

- Use if no dividend, want to value debt + equity

- FCFE (Free Cash Flow to Equity): Cash left only for shareholders.

- Use if no dividend, want to find shareholder value

- P/E Ratios (Price/Earnings): Higher = more growth expected.

- Use if comparing or want quick valuation

- Other Ratios: Price/Book, Price/Cash-Flow, Price/Sales.

- Use if negative earnings, worried about accounting tricks

- Dividend Discount Model (DDM): Values a stock by estimating all future dividends and discounting them back to the present.

- Intrinsic Value: What the stock is truly worth (based on fundamentals).

- Use discount rate (k) to bring future cash flows to today’s value.

- Growth Concepts

- g (growth rate) = ROE × b

- ROE: Return on Equity

- b: Retention ratio (earnings kept in business)

- More reinvestment = more growth

- Multistage Models are for companies that grow fast first, then slow down.

- Two-stage model: High growth for a few years then stable growth.

- Price/Earnings (P/E) Ratio: P/E = Price / Earnings

- Adjusted by growth: PEG Ratio = P/E / Growth rate

- No growth? P/E = 1 / k

- Risk: P/E ratios go down when

- Interest rates go up

- Inflation rises

- Company is risky

- Earnings can be manipulate, look at cash flows too.

Options

- A call option gives the right to buy a stock at a set price before a certain date.

- Go up when stock price goes up.

- Go down when strike price goes up.

- More valuable with higher volatility.

- A put option gives the right to sell a stock at a set price before a certain date.

- Go down when stock price goes up.

- Go up when strike price goes up.

- Also more valuable with higher volatility.

- Buying an option gives rights, not obligations.

- Selling (writing) an option gives obligations, not rights.

- Strike Price: The price you can buy or sell the stock for.

- Premium: What you pay to buy the option.

- In the Money: Exercising the option makes money.

- Out of the Money: Exercising the option loses money.

- At the Money: Stock price = strike price.

- Options can be traded on exchanges (standardized) or OTC (customized).

- American options can be used anytime before they expire.

- European options can only be used at expiration.

- Bermuda: Can be exercised at specific times

- Zero-Sum Game: One traders gain = another’s loss.

- Binomial Option Pricing assumes stock goes up or down by certain amounts. Use math to match option payoff.

- Black-Scholes Model is a complex formula for European options based on constant interest rates and stock volatility.

- Put-Call Parity links the price of calls and puts. Works only for European options without dividends.

- Basic Strategies

- Protective Put: Buy stock + buy put to limit losses.

- Covered Call: Buy stock + sell call to earn income.

- Straddle: Buy call + put to profit from big moves either way.

- Spread: Buy at favorable strike price sell option at less favorable strike

- Collar: Buy stock + buy put + sell call to limit both gains and losses.

- Advanced Strategies

- Short Straddle: Sell both a call and a put, bet on low movement.

- Long Call Butterfly: Buy one call option at a low strike price, sell two call options at a middle strike price, and buy one call option at a high strike price.

- Long Put Butterfly: Buy one put option at a high strike price, sell two put options at a middle strike price, and buy one put option at a low strike price.

- Option-Like Securities

- Callable Bonds: Company can buy back bonds early.

- Convertible Bonds: Can be swapped for stock.

- Warrants: Company-issued call options.

- Collateralized Loans: Borrower can choose to repay or walk away based on value of the collateral.

Fintech

- FinTech is tech applied to financial services to make them faster, cheaper, and more accessible.

- How it helps: Cuts costs, widens access, drives innovation, appeals to younger, digital users

- Key Areas of FinTech

- Payments: Mobile wallets, real-time transfers, buy now pay later

- WealthTech: Robo-advisors, trading apps, algorithms

- Lending: Online loans, P2P platforms, credit scored by AI

- InsurTech: Smarter, personalized insurance using data

- Big Data and AI: Powers credit scoring, fraud detection, personalization

- Blockchain & Digital Currency: Decentralized finance, smart contracts, crypto

- Open Banking: Apps use your banking data to offer better services

- RegTech: Automates compliance, lowers regulatory costs

- Risks: Cybersecurity threats, regulatory uncertainty, bias in algorithms, inexperience in financial fundamentals