Debt and Money Markets

Summary: We can income off buying Government and Corporate Debt, which have specifications. No free lunch, only way to win is to predict the interest rate.

Introduction to Fixed Income Securities

| Debt vs Equity | Debt | Equity |

|---|---|---|

| Payment Amount | Fixed | Variable |

| Payment | Fixed | Variable |

| Seniority | First | Last |

| Duration | Fixed | Perpetual |

| Liquidity | Low | High |

| Variety | Infinite | One |

- Geometric Mean: Multiple all numbers, then do that to the power of 1/n (nth square root)

- Bond Valuation: Add all of [Coupon/(1 + YTM)^year], Coupon + Par for last payment

- Rate theories: What determines interest rates?

- Market Segmentation: Each time interval determined separately

- Liquidity Premium: The longer the term the higher the rate

- Expectation: Price based off what people think future will be

- Determinants of Value:

- Expected Cash Flow: Positive correlation

- Timing of Cash Flow: Sooner is better

- Discount Rate: Inverse correlation (as it is in the denominator)

- If coupon > yield, premium, if coupon < yield, discount, if equal price is par

- Convergence: Over time the price approaches par

- Convexity: Greater percent change when discount rates decrease

- Coupon: Less coupon bonds more sensitive to price

- Chronological: Longer term more sensitive to price

Interest Rates

- Risk Free Rate: US Treasuries

- Federal Reserve Policy

- Supply and Demand

- Exogenous (external factors)

- Spread determinants: Credit risk (will it default), liquidity risk (can I sell), time to maturity

- Credit risk based off seniority and recovery rate (assets backing), rating agencies inflate, lag

- 4 C’s: Capacity (can they repay), Collateral (assets), Covenants (rules agreed to), Character (management)

- Capacity determined by ratios: Pros: simple, trends, audited statements. Cons: No benchmark, snapshot, past not future

- Liquidity: Short term cash.

- Current Ratio: (current assets/current liabilities)

- Quick ratio ((current assets-inventory)/current liabilities)

- Net Working Capital: (current assets – current liabilities)

- Working capital: How well is firm managing inventory and trade

- Average collection or Days Receivable: (Accounts Receivables / Sales) * 365

- Payables Period or Days Payable: (Accounts Payable / Cost of Goods Sold) * 365

- Inventory Holding or Conversion: (Inventory / Cost of Goods Sold) * 365

- Cash Conversion Cycle = Days Receivable + Inventory Holding – Payables Period

- Profitability: How much money are you making: Gross profit = revenue – cost of goods sold (COGS). Net income is the amount of money a company makes after subtracting all expenses and taxes from revenue.

- EBITDA: Earnings before interest, taxes, depreciation and amortization, Free Cash Flow

- Margins: Gross Profit = Profit/Sales, Net Profit = Income/Sales, Operating = EBIT/Sales

- Return on Equity = Net Income / Equity

- Return on Assets = Net Income / Assets

- Capital Structure: Debt Ratio = Total Liabilities / Total Assets

- Coverage Ratios

- Interest Coverage = EBIT/ Interest Expenses, MIGHT use EBITDA, DA is depreciation/amortization

- Efficiency Ratios:

- Total Asset Turnover = Sales/Assets

- Fixed Asset Turnover = Sales / Fixed Assets (assets that are hard to convert to cash, like a building)

- DuPont: ROE = Net Income / Equity = (Net Income/Sales) * (Sales/Assets) * (Assets/Equity)

- Rate theories: What determines interest rates?

- Market Segmentation: Each time interval determined separately

- Liquidity Premium: The longer the term the higher the rate

- Expectation: Price based off what people think future will be

- Calculating Spot/Forward: All the rates multiplied should be same on both sides (no arbitrage principle)

Bond Pricing

- Input dates on Calculator with MM.DDYYYY format, to find change, type in first date, delta date button, second date, delta date

- When in between coupons:

- NOTE: t = time passed from payment, so accrued time, T = payment period (subtract dates if act/act)

- Find PV with N, I (account for period), PMT (account for period), FV=Par

- Full Price: Find FV with N = t/T, PV=what we got above, I (account for period, same as above)

- Accrued Interest: Coupon * t/T

- Flat Price (Clean Price, what we use to compare) = Full Price – Accrued Interest

- If YTM is given replace I with YTM/(P/Y)

- Inverse: Yield and price are inverse, as yield represents opportunity cost, so you need to be compensated for it with price

- Convexity: Decrease in rate cause greater percent increase in price, because lowering rate represents bigger delta % in rate

Callable Bonds

- Callable bonds can be redeemed by the issuer at a specific time and price. This makes them cheaper, since there’s a chance they get called, which would be disadvantageous for the buyer.

- To price:

Convexity

- Convexity is a measure of the curvature in the price-yield relationship of a bond. It explains how duration of a bond changes as interest rates change.

- Positive convexity: Bond prices rise faster when rates fall and drop slower when rates rise. Most vanilla bonds have this.

- Negative convexity: The reverse—price gains are limited when rates fall. Callable bonds often exhibit this.

- Callable bonds underperform when rates fall (due to call risk).

- We can use calculus to estimate.

Bonds with Embedded Options

- Options: Derivatives that give option to buy or sell, zero sum (someone’s win is another’s loss)

- American (continuous), European (expiration only), Bermuda (Set times)

- Callable: Issuer can buy back at specified time and price, they only will if it benefits them, always cheaper/same

- Call option more valuable at lower yields, call puts limit on bond value increases

- Remember option free bonds have positive convexity (yield decreases have bigger impact)

- Call option more valuable at lower yields, call puts limit on bond value increases

- Putable bonds: lets buyers sell, makes the bond more expensive

- If a bond is not callable don’t use the tree, use spot rates

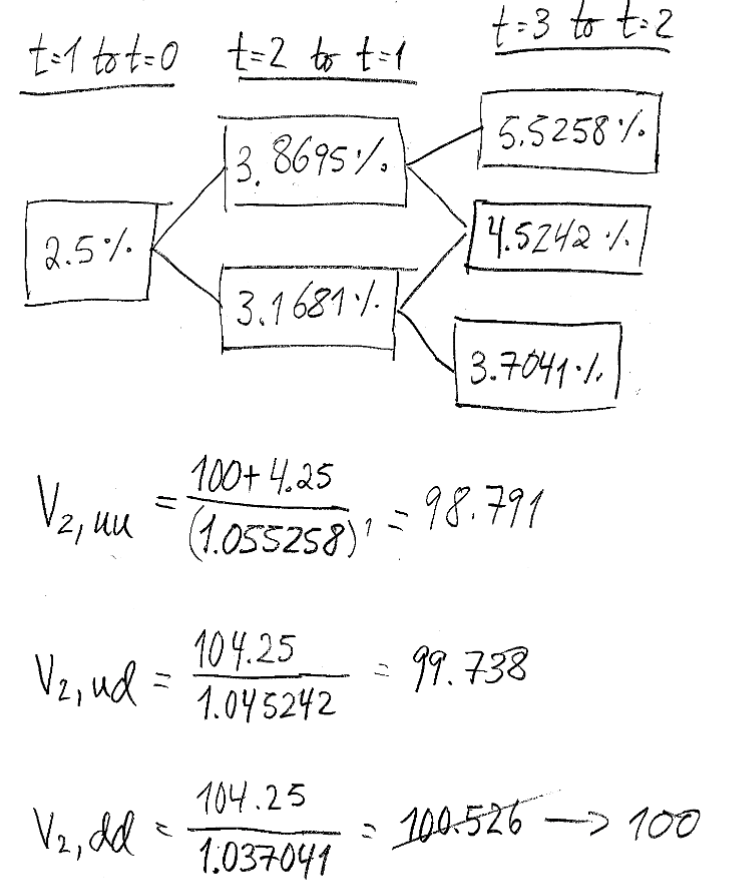

- Binomial Tree: Up and down scenarios

- Do steps in the picture to find year two prices, then discount back to year one with same process sum all (probability * price) then add coupon.

Mortgage Backed Securities

- MBS: Bundles of mortgages, securitized (able to be split) + sold to investors

- Process: Banks make loans -> Separate entity -> Entity issues -> Entity underwrites (accepts liability)

- Pros: Direct investment in mortgages, more mortgages active, cheaper rates, liquidity, bank profit

- Cons: More mortgages = more risk, hard to observe risk (since bundled)

- Amortization: Gradual reduction of principal over time

- Weighted Average Coupon = Sum of [(Individual Mortgage/Total Mortgage) * Rate of individual mortgage]

- Weighted Average Maturity= Sum of [(Individual Mortgage/Total Mortgage) * Duration of individual mortgage]

- Pass through: What the investor actually gets after bank fees

- Single Monthly mortality rate: Public security association benchmark of 0.2% defaults per month, increasing by 0.2% until month 30.

- Risks: Contraction (prepayments on low rates), Extension (less prepayments on high rates)

- Tranches: Tiers, there’s sequential (senior paid first) and credit or default (junior takes default losses first)

- Prepayment: Adds to tranche cash flow

- Defaults: Does NOT add to tranche cash flow, this is lost money

Total MBS

| Year | Beginning Balance | Payment | Interest | Principal | End Balance |

| First one given, after that use end balance of previous column | N = Total Years I = WAC PV = BB Find PMT | BB*WAC | PMT – I | BB – Principal |

Time Tranche (Junior doesn’t get paid until senior completely paid off, default risk is porportional)

| Year | Beginning Balance | Interest | Principal | End Balance | Cash Flow |

| First one given, after that use end balance of previous column, it’s the proportion of tranche | BB*Pass through | PMT – I | BB – Principal | Principal + Interest |

Credit Tranche (Junior tranche wiped out first, the secret to doing these is to rebalance the allocation of payment following tranches disproportionally taking a default loss)

| Year | Beginning Balance | Interest | Principal | End Balance | Cash Flow |

| First one given, after that use end balance of previous column, it’s the proportion of tranche | BB*Pass through | PMT – I | BB – Principal | Principal + Interest |